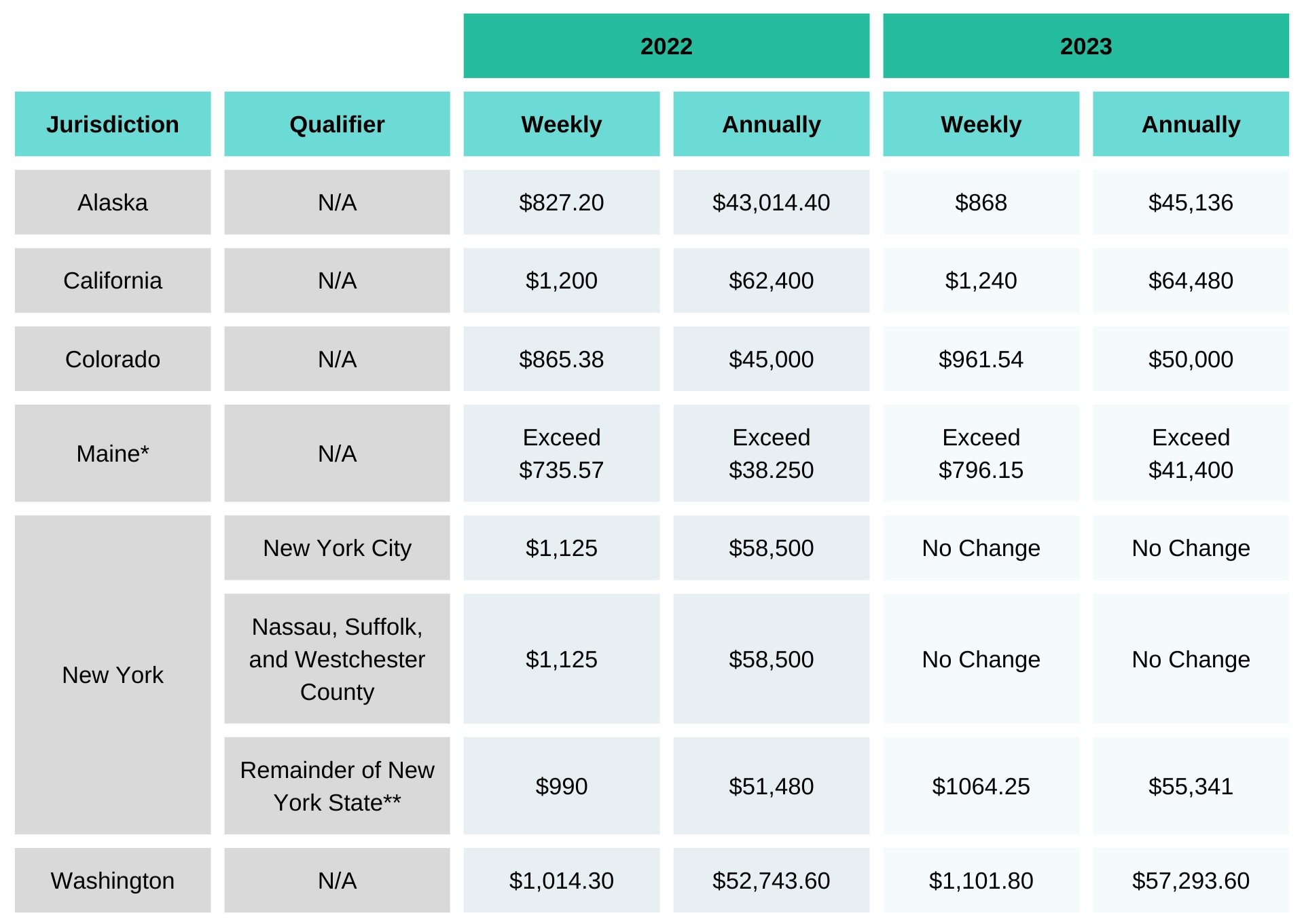

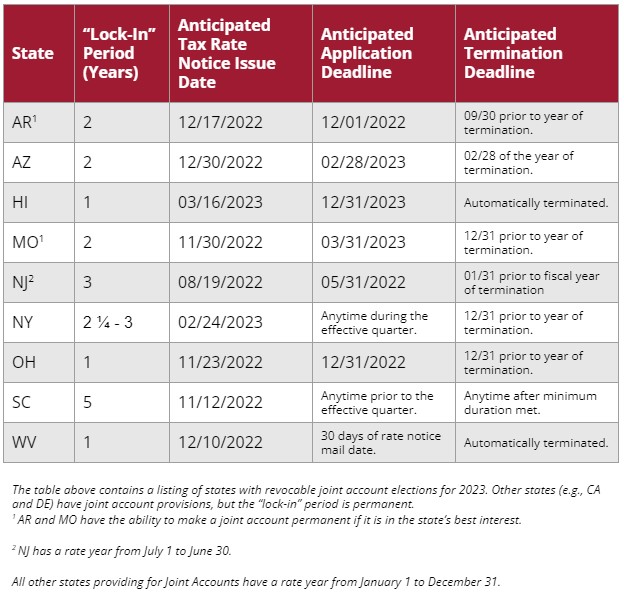

Salary Exemption Threshold 2025. These salary requirements do not apply to outside sales employees,. Plan now for new exempt salary threshold starting in 2025.

The revised regulations would establish the salary threshold for the executive, administrative and professional exemptions at the 35th percentile of weekly earnings of. The salary threshold would increase from the current $684 per week ($35,568 per year) to $1,059 per week ($55,068 per year)—a 55% increase from the.

Coming on march 13, 2025, the salary thresholds for exemptions from pay frequency laws will jump from $900 per week to $1,300 per week.

Leave Salary Exemption Section 10(10AA) GST Guntur, As proposed, the minimum salary threshold for eap exemptions would increase to $1,059 per week ($55,068 per year), a greater than 50% jump from the. The final rule is expected in april, 2025.

Salary Exemption to Minimum and Overtime Wages TowLawyer, As a result of a change in the. The salary threshold would increase from the current $684 per week ($35,568 per year) to $1,059 per week ($55,068 per year)—a 55% increase from the.

TDS Rate Chart for FY 202223 (AY 202524), Employment & labor (u.s.), new york employment beat, wage and hour. In washington state, the salary threshold exemption is $1,302.40/week ($67,724.80 a year) for 2025.

Overtime Exemption Salary Threshold Increased, The salary threshold would increase from the current $684 per week ($35,568 per year) to $1,059 per week ($55,068 per year)—a 55% increase from the. To qualify for exemption, employees generally must be paid at not less than $684* per week on a salary basis.

US Employment Law 2025 Updates — PGC Group Employer of Record USA, The revised regulations would establish the salary threshold for the executive, administrative and professional exemptions at the 35th percentile of weekly earnings of. The 2025 salary exemption rule represents a significant shift in how employers determine which employees are eligible for overtime pay.

Exempt Employee Salary Threshold Rises Across The United States in 2018, The final rule is expected in april, 2025. As proposed, the minimum salary threshold for eap exemptions would increase to $1,059 per week ($55,068 per year), a greater than 50% jump from the.

DOL Proposes New Salary Threshold for Overtime Exemption, Posted in employment & labor (u.s.), us alert. Department of labor dol has proposed the threshold salary level for exemption from overtime be raised from $35568 per year to $55000 per year.

All About Leave Salary Exemption Under Section 10(10A), As a reminder, the dol has proposed the threshold salary level for exemption from overtime be raised from $35,568/year ($684/week) to $55,000/year. Coming on march 13, 2025, the salary thresholds for exemptions from pay frequency laws will jump from $900 per week to $1,300 per week.

Calculate payroll withholding 2025 JasmenBatool, Plan now for new exempt salary threshold starting in 2025. The revised regulations would establish the salary threshold for the executive, administrative and professional exemptions at the 35th percentile of weekly earnings of.

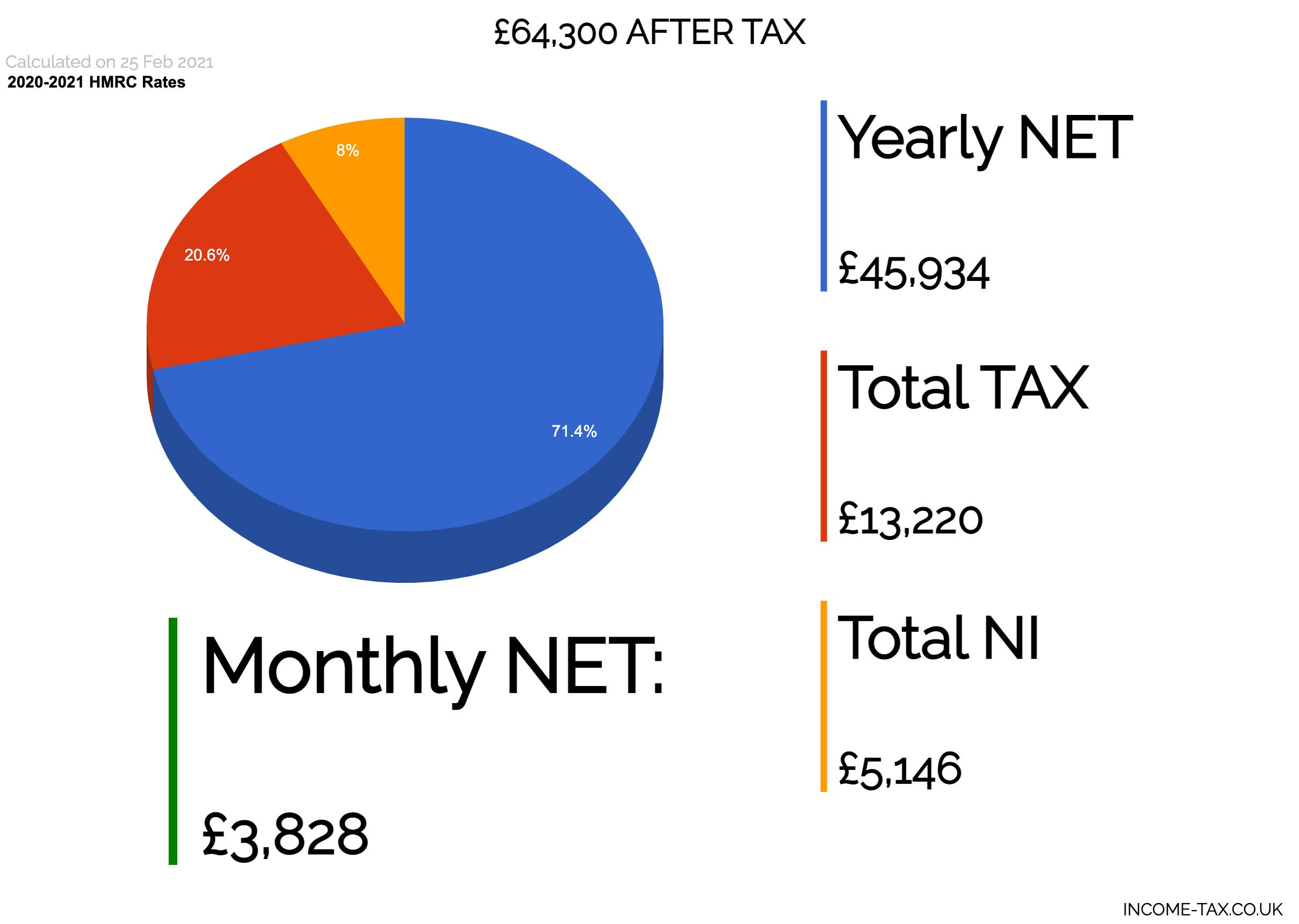

£64,300 After Tax 2025/2025 Tax UK, New york city and the rest of “downstate” (nassau,. Department of labor dol has proposed the threshold salary level for exemption from overtime be raised from $35568 per year to $55000 per year.

The minimum salary required for exemption is two times the state minimum wage for the first 40 hours of employment each week.

The revised regulations would establish the salary threshold for the executive, administrative and professional exemptions at the 35th percentile of weekly earnings of.